How to Form a US LLC: Complete Guide for 2025

Forming a Limited Liability Company (LLC) in the United States is one of the most popular choices for entrepreneurs and business owners seeking liability protection, tax flexibility, and operational simplicity. Whether you're a domestic entrepreneur or an international business owner, understanding the LLC formation process is crucial for making informed decisions about your business structure.

This comprehensive guide will walk you through every step of forming a US LLC, from understanding the benefits to ongoing compliance requirements, with special attention to foreign ownership opportunities.

Key Takeaways

- • LLCs provide liability protection while maintaining operational flexibility

- • Pass-through taxation can result in significant tax savings

- • Foreign owners can benefit from special tax advantages

- • State selection impacts costs, privacy, and legal protections

- • Proper financial management is crucial for maximizing LLC benefits

Understanding a US LLC

A Limited Liability Company (LLC) is a business structure in the United States that combines the limited liability protection of a corporation with the tax benefits and operational flexibility of a partnership. This hybrid structure makes LLCs an attractive option for many business owners.

LLCs are formed under state law, which means the specific rules and requirements can vary from state to state. However, the fundamental benefits remain consistent across all states.

Benefits of Forming a US LLC

Limited Liability Protection

The primary benefit of an LLC is the limited liability protection it provides to its owners (called "members"). This means that members are generally not personally liable for the debts and obligations of the LLC. Your personal assets, such as your home, car, and personal bank accounts, are protected from business creditors.

Tax Flexibility and Benefits

LLCs offer significant tax advantages through pass-through taxation. Unlike corporations, which face double taxation, LLC profits and losses "pass through" to the members' personal tax returns. This means the LLC itself doesn't pay federal income taxes, potentially saving thousands of dollars annually.

Operational Flexibility

LLCs provide remarkable flexibility in management structure and operations. Unlike corporations, which require boards of directors, formal meetings, and extensive record-keeping, LLCs can be managed by their members or appointed managers with minimal formalities.

Step-by-Step LLC Formation Process

Step 1: Choose Your State

The first and most important decision is selecting the state where you'll form your LLC. While you can form an LLC in any state regardless of where you live or operate your business, each state has different advantages:

Delaware

- • Business-friendly courts

- • Strong legal precedents

- • Privacy protections

- • No state income tax for non-residents

Wyoming

- • Lowest formation costs

- • Strong privacy laws

- • No state income tax

- • Minimal reporting requirements

Nevada

- • No state income tax

- • Strong asset protection

- • Business-friendly environment

- • Minimal disclosure requirements

Step 2: Choose a Name for Your LLC

Your LLC name must be unique within the state and include "LLC," "Limited Liability Company," or an approved abbreviation. Before settling on a name, check availability through the state's business entity database and consider trademark searches to avoid conflicts.

LLC Naming Requirements:

- • Must include "LLC" or "Limited Liability Company"

- • Cannot be the same as existing business names in the state

- • Cannot include restricted words (Bank, Insurance, etc.)

- • Should be available as a domain name for online presence

Step 3: Appoint a Registered Agent

Every LLC must have a registered agent - a person or company designated to receive legal documents and official correspondence on behalf of the LLC. The registered agent must have a physical address in the state of formation and be available during normal business hours.

Step 4: File Articles of Organization

The Articles of Organization (also called Certificate of Formation in some states) is the official document that creates your LLC. This document typically includes basic information about your LLC, such as its name, address, registered agent, and management structure.

Step 5: Obtain an EIN (Employer Identification Number)

An EIN, also known as a Federal Tax ID number, is required for tax purposes and to open business bank accounts. You can obtain an EIN directly from the IRS website for free, and it's typically issued immediately for online applications.

Step 6: Create an Operating Agreement

While not required in all states, an Operating Agreement is crucial for defining the ownership structure, management responsibilities, and operational procedures of your LLC. This document helps prevent disputes and provides clarity on important business decisions.

Step 7: Open a Business Bank Account

Maintaining separate business and personal finances is essential for preserving your LLC's liability protection. Open a dedicated business bank account using your EIN and Articles of Organization as documentation.

Step 8: Set Up Financial Management with MyPrivateLedger

Proper financial management is crucial for maximizing your LLC's benefits and maintaining compliance. MyPrivateLedger offers specialized features designed specifically for LLC owners:

MyPrivateLedger for LLCs:

Automated Expense Tracking

Connect your business accounts and automatically categorize LLC expenses for maximum tax deductions.

Multi-Member Management

Track individual member contributions, distributions, and ownership percentages with automated K-1 preparation.

Tax Optimization

Maximize pass-through tax benefits with intelligent expense categorization and deduction tracking.

Compliance Monitoring

Automated reminders for annual reports, tax deadlines, and state compliance requirements.

Managing Your LLC Finances with MyPrivateLedger

Once your LLC is formed, effective financial management becomes crucial for maximizing tax benefits and maintaining compliance. MyPrivateLedger provides comprehensive tools specifically designed for LLC owners:

Automated Expense Tracking for Maximum Deductions

LLCs can deduct a wide range of business expenses, but tracking them manually is time-consuming and error-prone. MyPrivateLedger automatically categorizes your expenses and identifies potential deductions you might miss:

- Pass-through taxation benefits: Since LLC profits flow through to your personal tax return, maximizing deductions directly reduces your personal tax liability

- Self-employment tax savings: Proper expense tracking can significantly reduce your self-employment tax burden

- Multi-member coordination: For LLCs with multiple members, the platform tracks each member's expenses and contributions separately

Professional Financial Reporting

MyPrivateLedger provides comprehensive financial reporting tailored for LLCs:

- Automated financial statements updated in real-time

- Member-specific reporting for multi-member LLCs

- Tax-ready documentation organized by category

- Professional presentation for lenders and investors

Real-Time Financial Dashboards

Monitor your LLC's financial health with intuitive dashboards that provide instant insights into cash flow, profitability, and tax obligations. Make informed business decisions with up-to-date financial data at your fingertips.

Ready to Optimize Your LLC Finances?

Join thousands of LLC owners who trust MyPrivateLedger for their financial management needs.

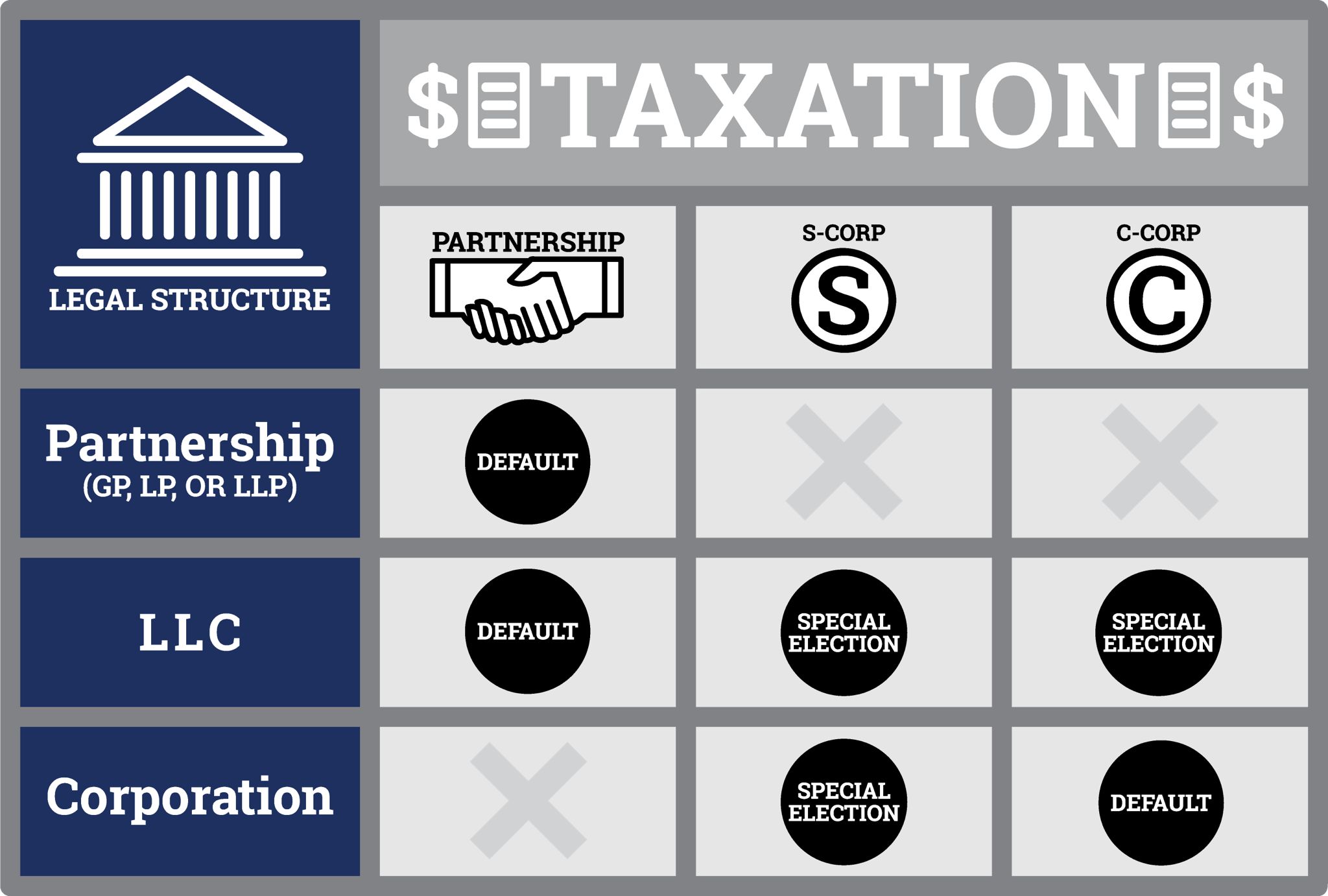

Tax Elections for LLCs

One of the primary benefits of LLCs is pass-through taxation, where the LLC's income is reported only once on the members' personal tax returns, avoiding the double taxation faced by corporations. This can result in significant tax savings and simplifies the tax filing process. Additionally, LLCs with two or more members default to being treated as a partnership for tax purposes unless they elect otherwise, providing various tax benefits.

For single-member LLCs, they are usually viewed as a disregarded entity unless they choose to be taxed as corporations. This means that the LLC's income is reported on the owner's personal tax return. However, if an LLC opts for the S corporation status, it must file Form 1120-S for federal tax purposes. Understanding these options allows LLC owners to optimize their tax strategies and potentially reduce their self employment tax and pay self employment taxes, considering their tax status.

MyPrivateLedger simplifies these complex tax decisions by providing automated tax calculations, scenario planning, and professional guidance to help you choose the optimal tax election for your LLC.

Foreign-Owned US LLCs: Special Considerations

For international entrepreneurs and non-US residents, forming a US LLC offers unique opportunities and tax advantages. Understanding the specific rules and benefits for foreign-owned LLCs is crucial for making informed decisions.

Tax Treatment for Non-Resident Single-Member LLCs

Key Tax Advantage: Non-resident US LLC single-member LLCs will not be taxed in the USA as long as they do not have any US Trade or Business activities, such as maintaining a warehouse, office, or employees in the United States. The income will then pass through to the country where you have tax residency status, and you will pay taxes there according to your home country's tax laws.

What Constitutes US Trade or Business

To maintain tax-free status in the US, foreign-owned LLCs should avoid:

- Physical presence: Warehouses, offices, or retail locations in the US

- US employees: Hiring staff or contractors working within the United States

- Regular business activities: Conducting ongoing business operations on US soil

- Dependent agents: Having representatives who regularly conduct business on your behalf in the US

Permitted Activities for Foreign-Owned LLCs

Foreign-owned LLCs can engage in these activities without triggering US taxation:

- Investment activities: Holding US stocks, bonds, or real estate investments

- Digital services: Providing online services to US customers from outside the US

- Import/export: Trading goods without maintaining US inventory or operations

- Intellectual property licensing: Licensing patents, trademarks, or copyrights to US entities

- Consulting services: Providing advisory services remotely from your home country

MyPrivateLedger for International LLC Owners

MyPrivateLedger offers specialized features for foreign-owned LLCs:

- Multi-currency support: Track expenses and income in multiple currencies

- International tax compliance: Guidance on reporting requirements in your home country

- Cross-border transaction tracking: Automated categorization of international payments

- Professional documentation: Generate reports suitable for foreign tax authorities

- Compliance monitoring: Alerts to ensure you maintain non-US trade or business status

Important Note for Foreign Owners:

For Non Resident US LLC Single member LLC's will not be taxed in the USA as long as they do not have any US Trade or Business such as a warehouse. It will then pass through to the country you have Tax status in and you will pay taxes there!

Comparing US LLCs with Other Business Structures

Understanding how LLCs compare to other business structures helps you make an informed decision:

| Feature | LLC | Corporation | Partnership | Sole Proprietorship |

|---|---|---|---|---|

| Liability Protection | Yes | Yes | No | No |

| Pass-Through Taxation | Yes | No | Yes | Yes |

| Management Flexibility | High | Medium | High | High |

| Formation Complexity | Low | High | Low | Very Low |

Ongoing Compliance and Maintenance

Maintaining your LLC requires ongoing compliance with state and federal requirements:

Annual Reports and Fees

Most states require LLCs to file annual reports and pay associated fees. These reports typically include basic information about the LLC's current address, registered agent, and members or managers.

Tax Obligations

While LLCs enjoy pass-through taxation, they still have various tax obligations including estimated quarterly payments, employment taxes (if applicable), and state tax requirements.

Record Keeping

Maintaining proper records is crucial for preserving liability protection and ensuring tax compliance. This includes financial records, meeting minutes (if applicable), and important business documents.

Common Mistakes to Avoid

Avoid These Common LLC Mistakes:

- • Mixing personal and business finances

- • Failing to maintain proper records

- • Ignoring state compliance requirements

- • Not having an Operating Agreement

- • Choosing the wrong state for formation

- • Inadequate financial management systems

Frequently Asked Questions

How long does it take to form an LLC?

Formation time varies by state, typically ranging from 1-15 business days for standard processing. Expedited processing is available in most states for an additional fee.

Can I form an LLC if I'm not a US citizen?

Yes, foreign nationals can form and own US LLCs. There are no citizenship or residency requirements for LLC ownership in most states.

How much does it cost to form an LLC?

State filing fees range from $50 (Wyoming) to $500+ (Massachusetts). Additional costs may include registered agent fees, operating agreement preparation, and ongoing compliance costs.

How can MyPrivateLedger help with my LLC?

MyPrivateLedger provides comprehensive financial management for LLCs, including automated expense tracking, tax optimization, multi-member management, and compliance monitoring. Our platform is specifically designed to maximize the benefits of LLC ownership while simplifying financial management.

Conclusion

Forming a US LLC offers significant advantages for both domestic and international entrepreneurs, including liability protection, tax flexibility, and operational simplicity. The key to maximizing these benefits lies in proper formation, ongoing compliance, and effective financial management.

Whether you're a US resident looking to protect your personal assets or a foreign entrepreneur seeking to access the US market, an LLC can provide the structure and benefits you need to succeed. With proper planning and the right tools, your LLC can become a powerful vehicle for business growth and financial optimization.